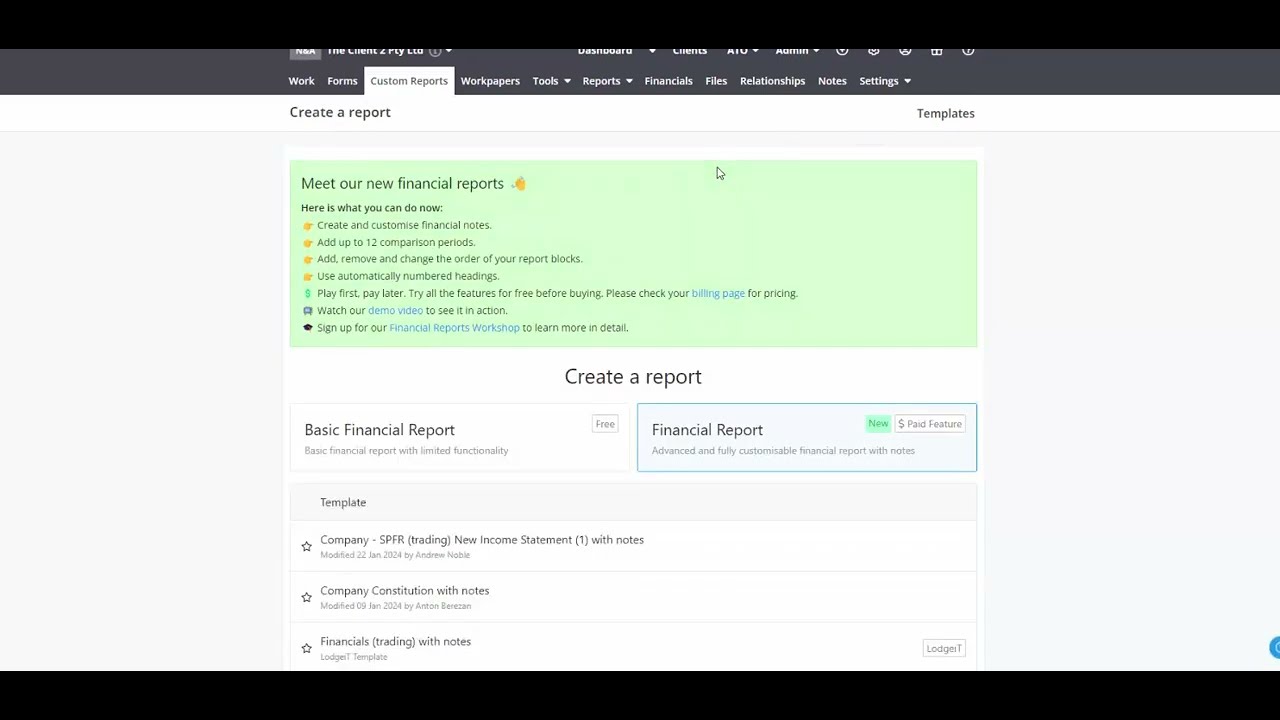

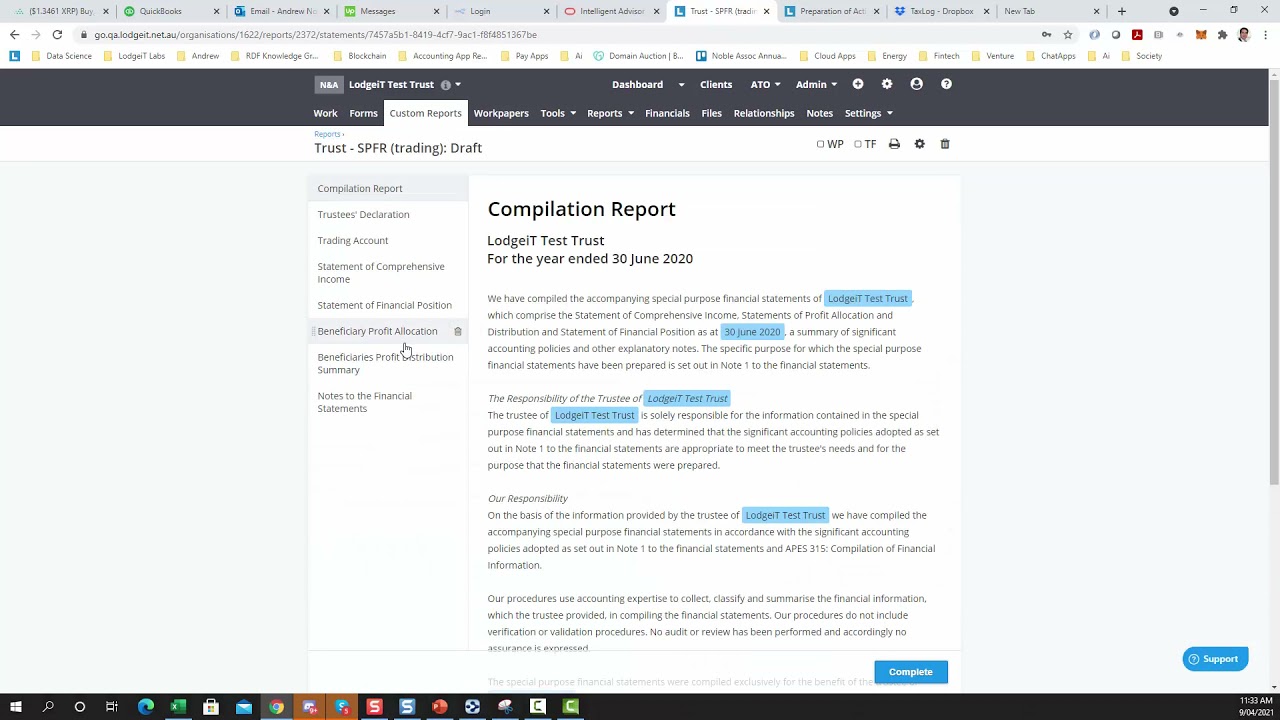

Financial Reports and Statements Tool – Financial Report

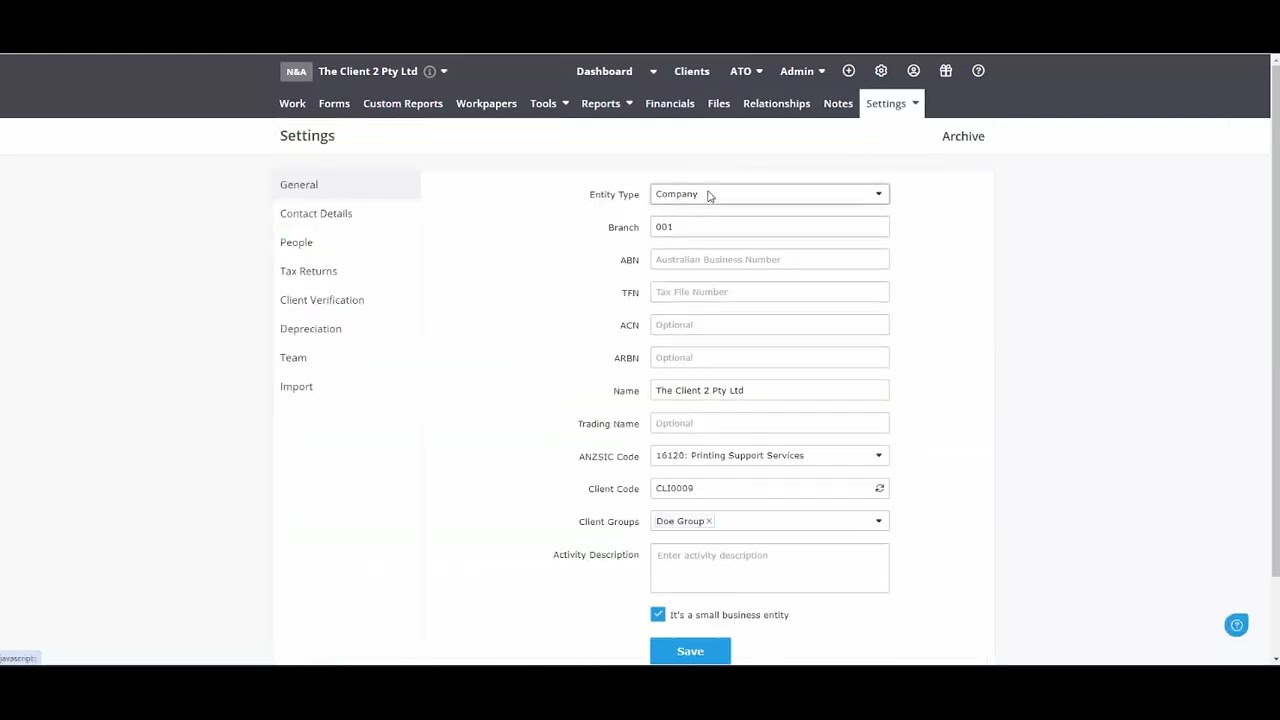

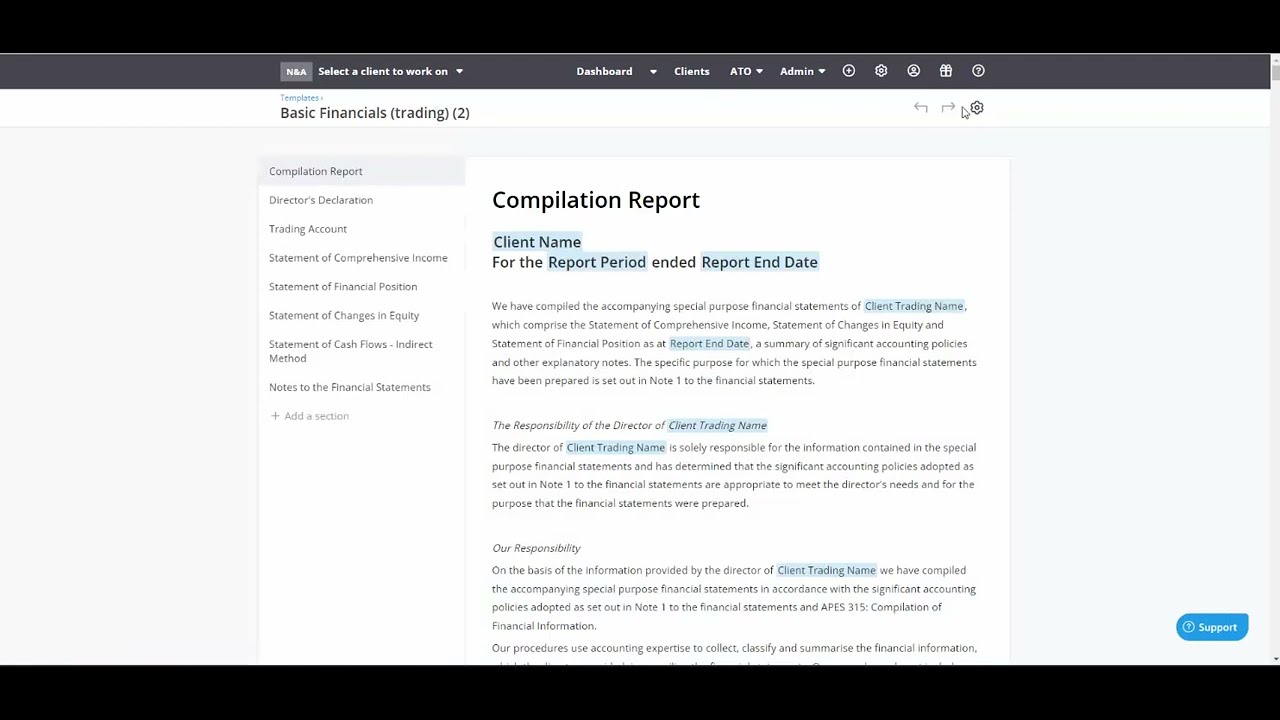

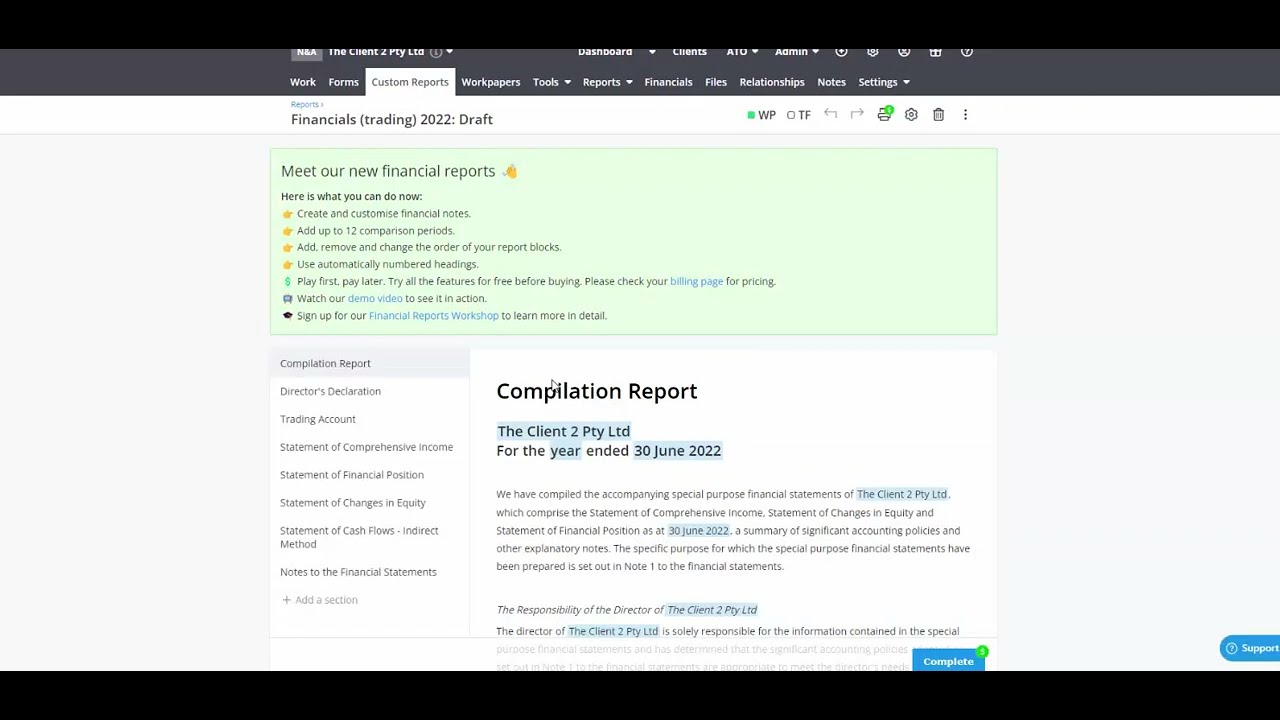

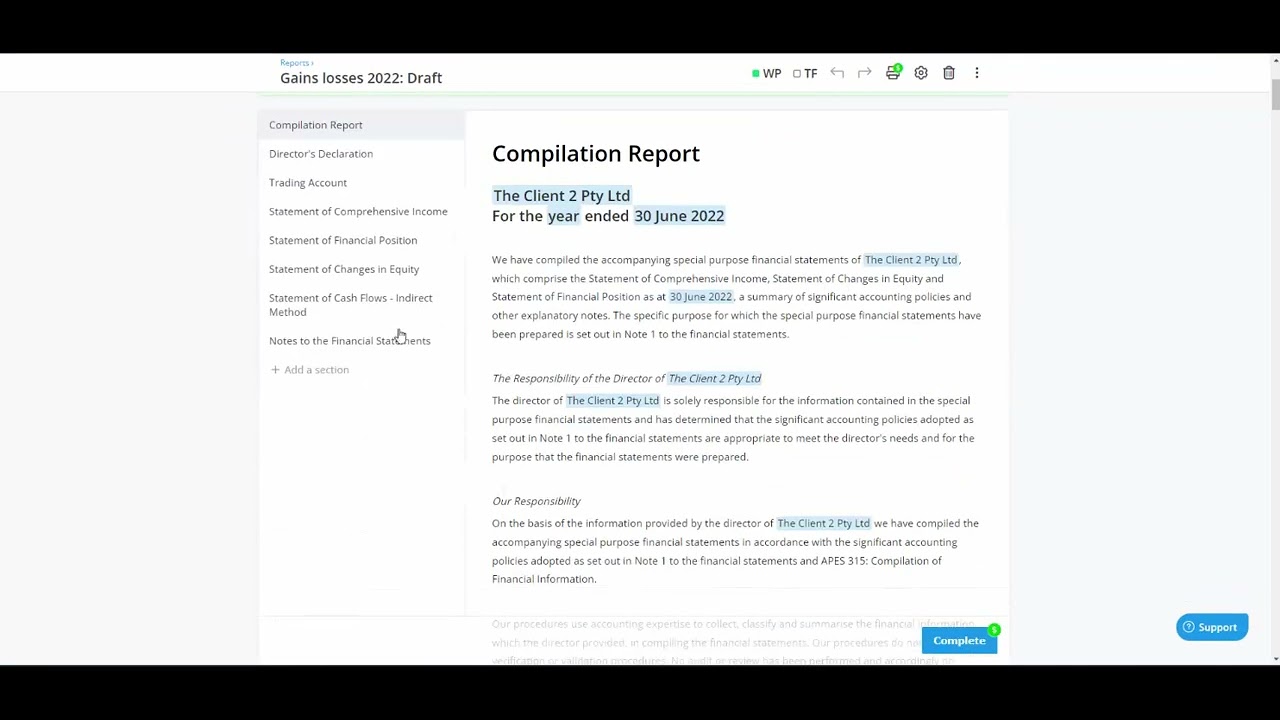

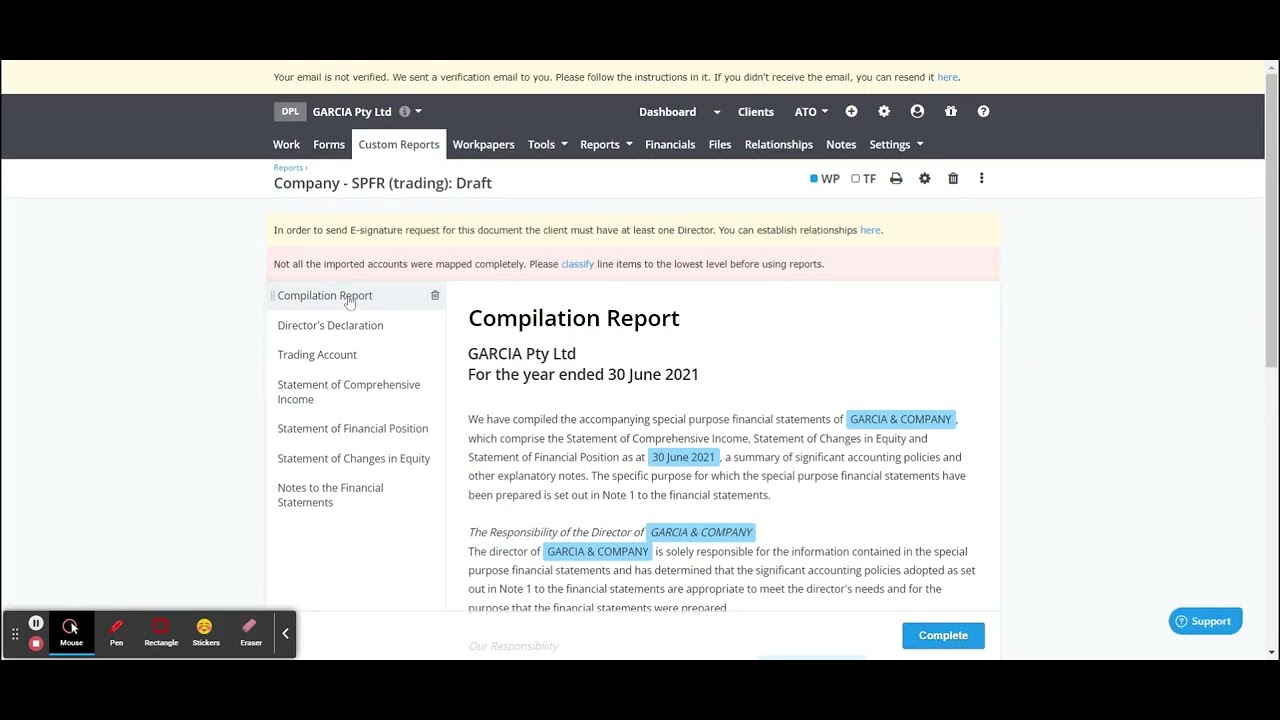

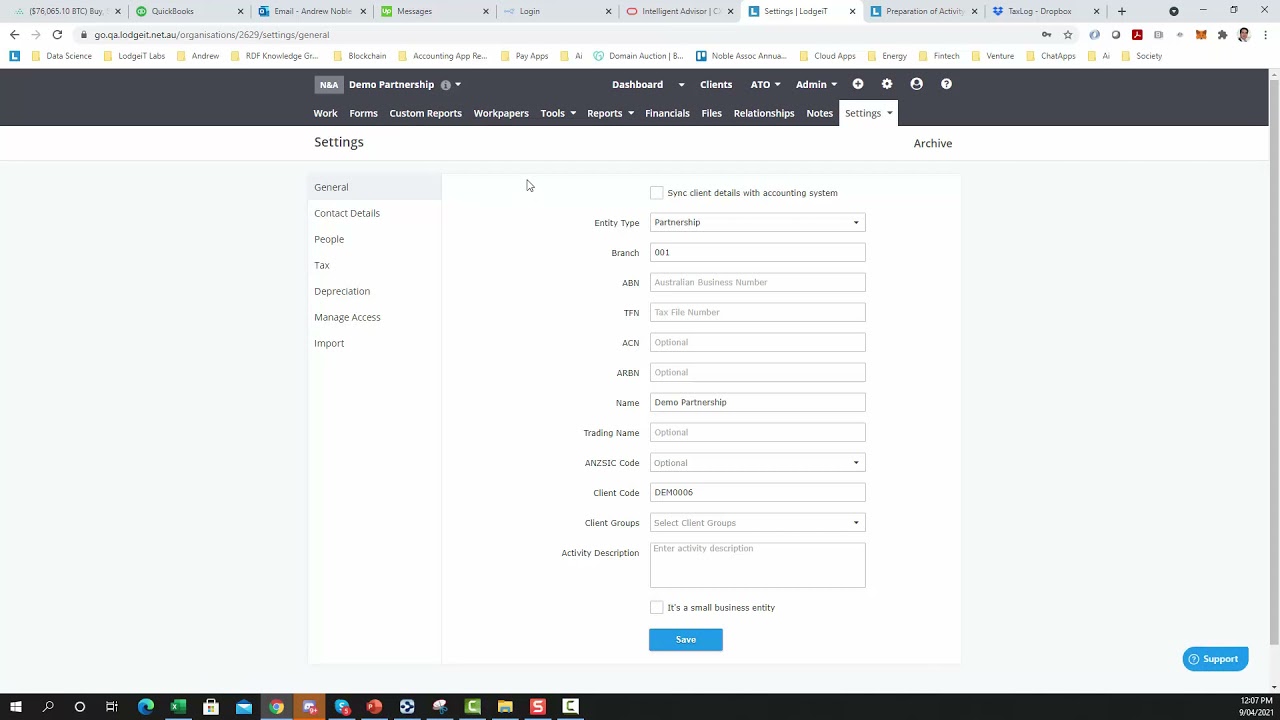

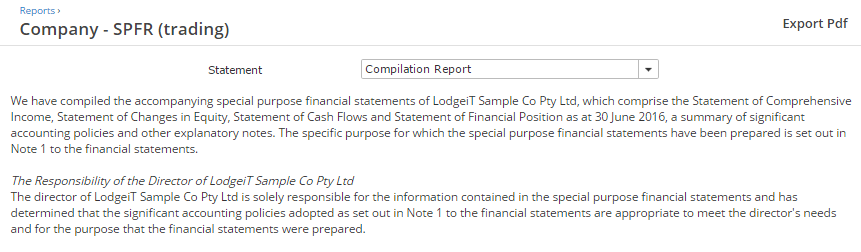

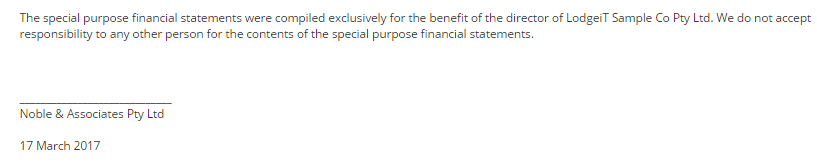

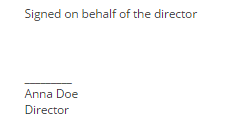

The LodgeiT SPFR Module is designed to streamline and automate the production of Financial Reports and Statements.

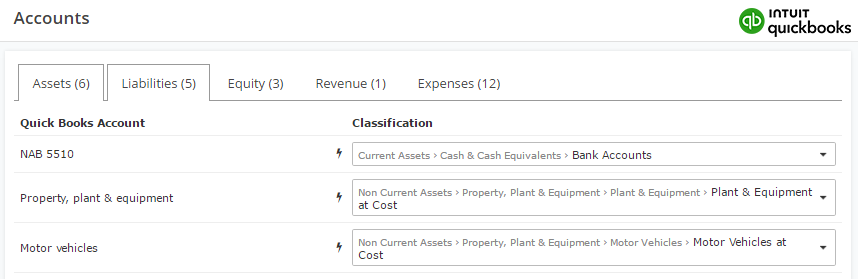

Unlike other reporting systems, the LodgeiT Module relies on a single import and classification exercise to populate Working Papers, the Tax Form and Financial Statements.

Financial Reports

22 Videos

Sign-Up To Our Statutory Financial Reporting Workshop

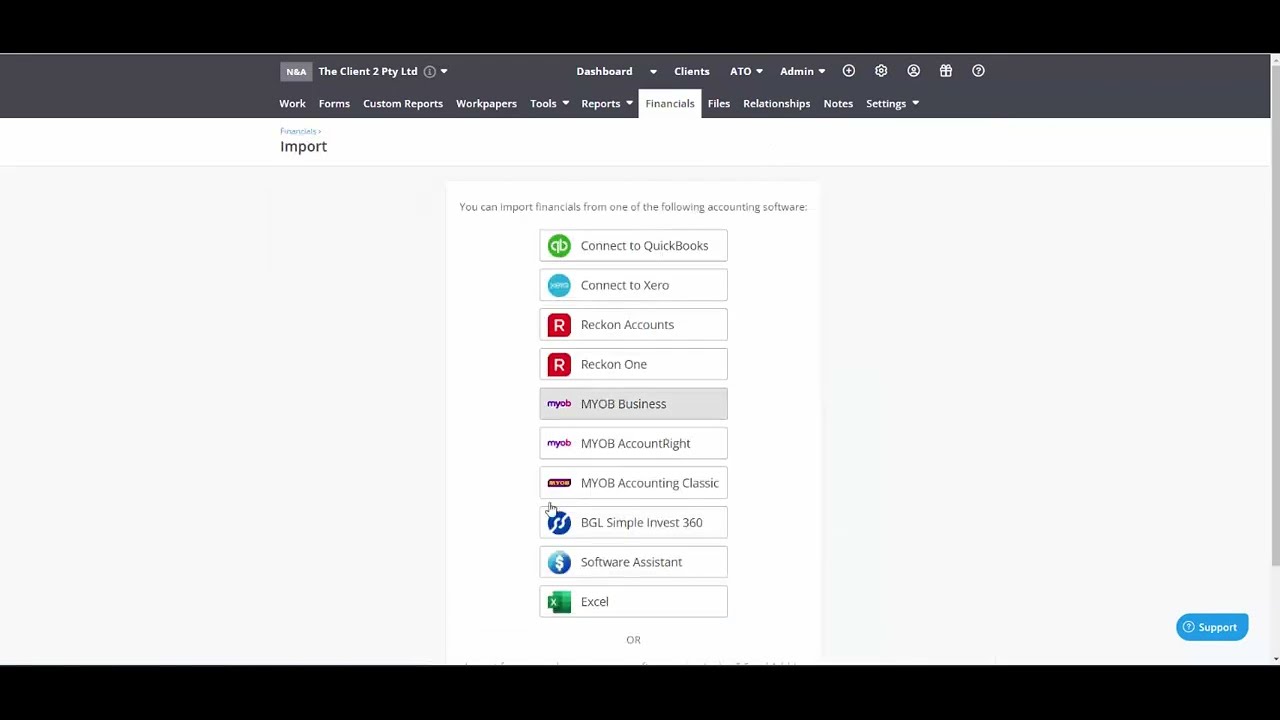

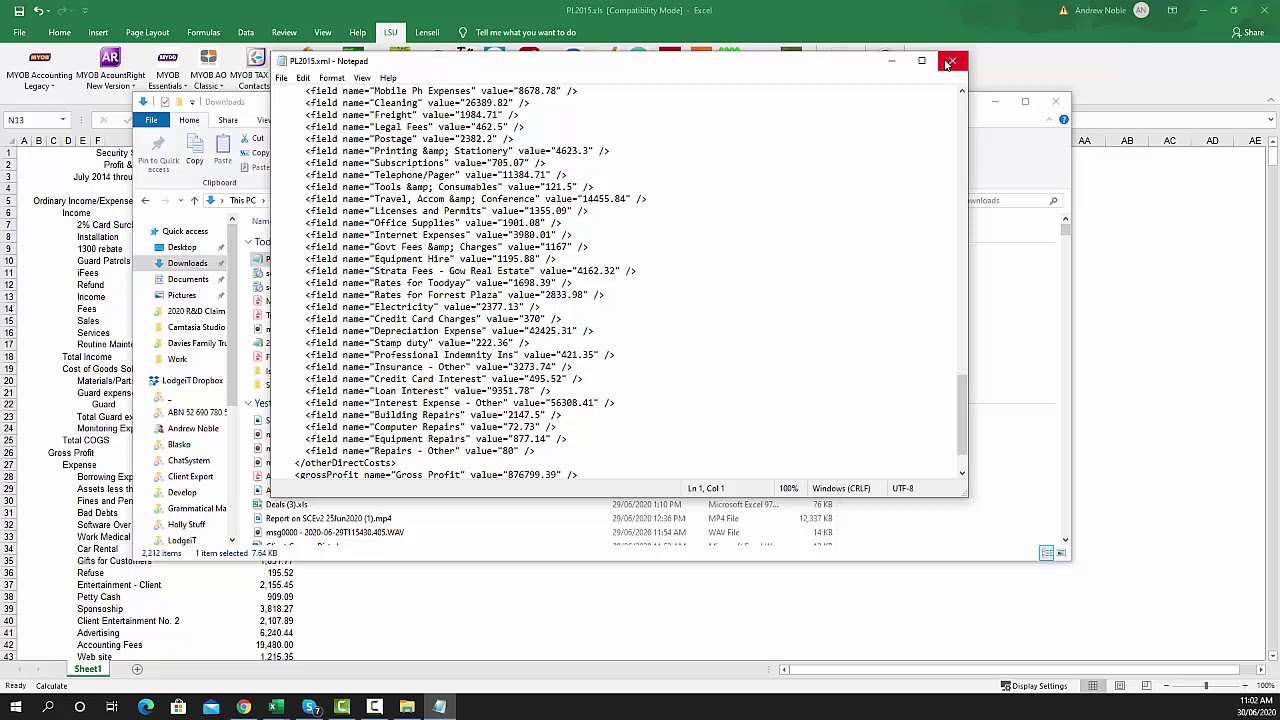

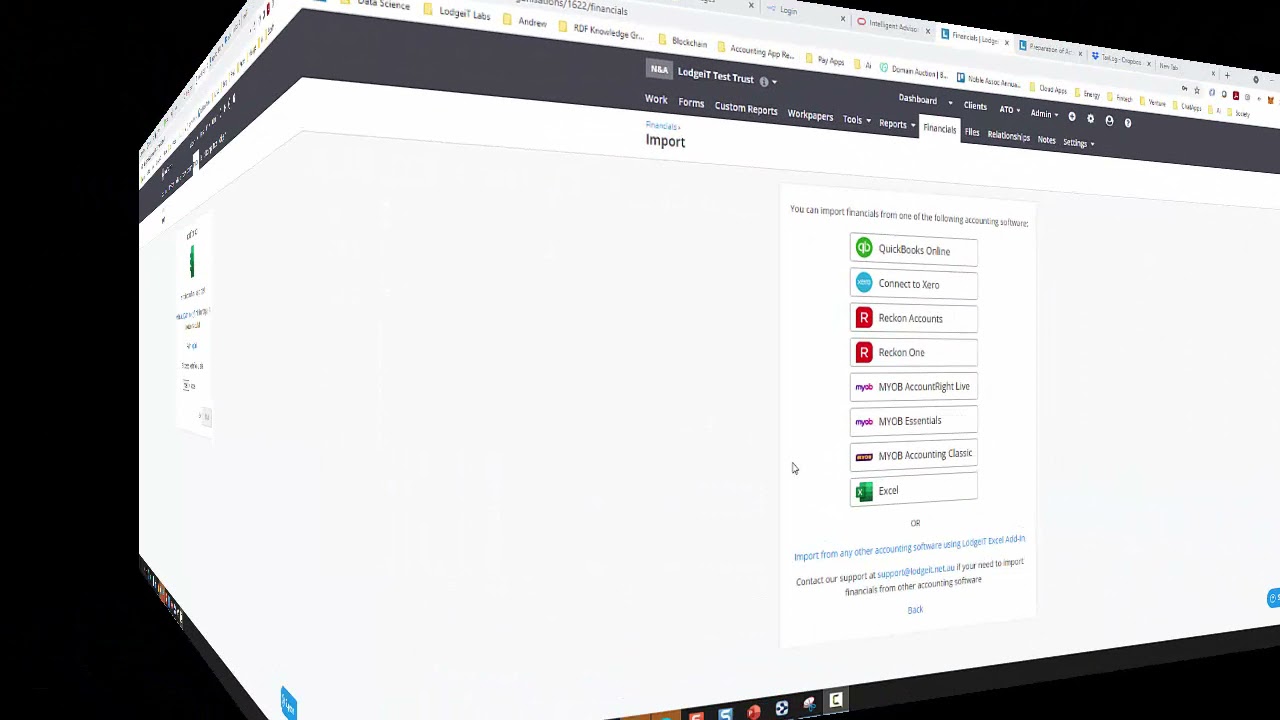

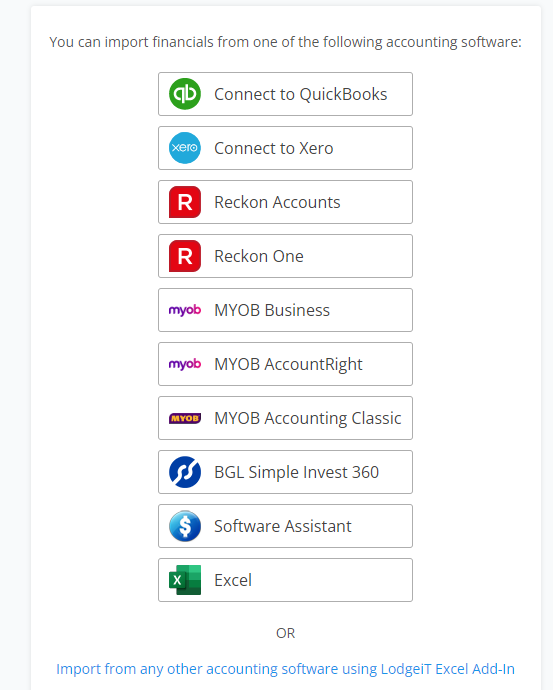

Import raw client-side financials from a range of Accounting Systems like Xero and Quickbooks

Generate Financial Reports by Month , Quarter or Year