Share/Crypto Trading vs. Investing

- August 18, 2022

The ATO have a perspective on trading versus investing – Read More

I helped Mr Wong prove to the ATO that he was trading on his wife’s behalf rather than merely investing. A single stock with a catastrophic loss of 100% of the cost base. Some significant proportion of the portfolio. Casino Royale style. Trading losses are much more valuable than capital losses. Especially when you can offset those losses against your wife’s doctor salary across three financial years. Explore the case law here.

Case law carries precedence of how judges have interpreted and applied the law before. By reading case law together with the legislation, a probability distribution can be estimated i.e. share traders typically hold positions for shorter timeframes than investors. Share traders are also more likely to use technical analysis. Plus, there are other considerations. It’s not a simple binary and/or or yes/no.

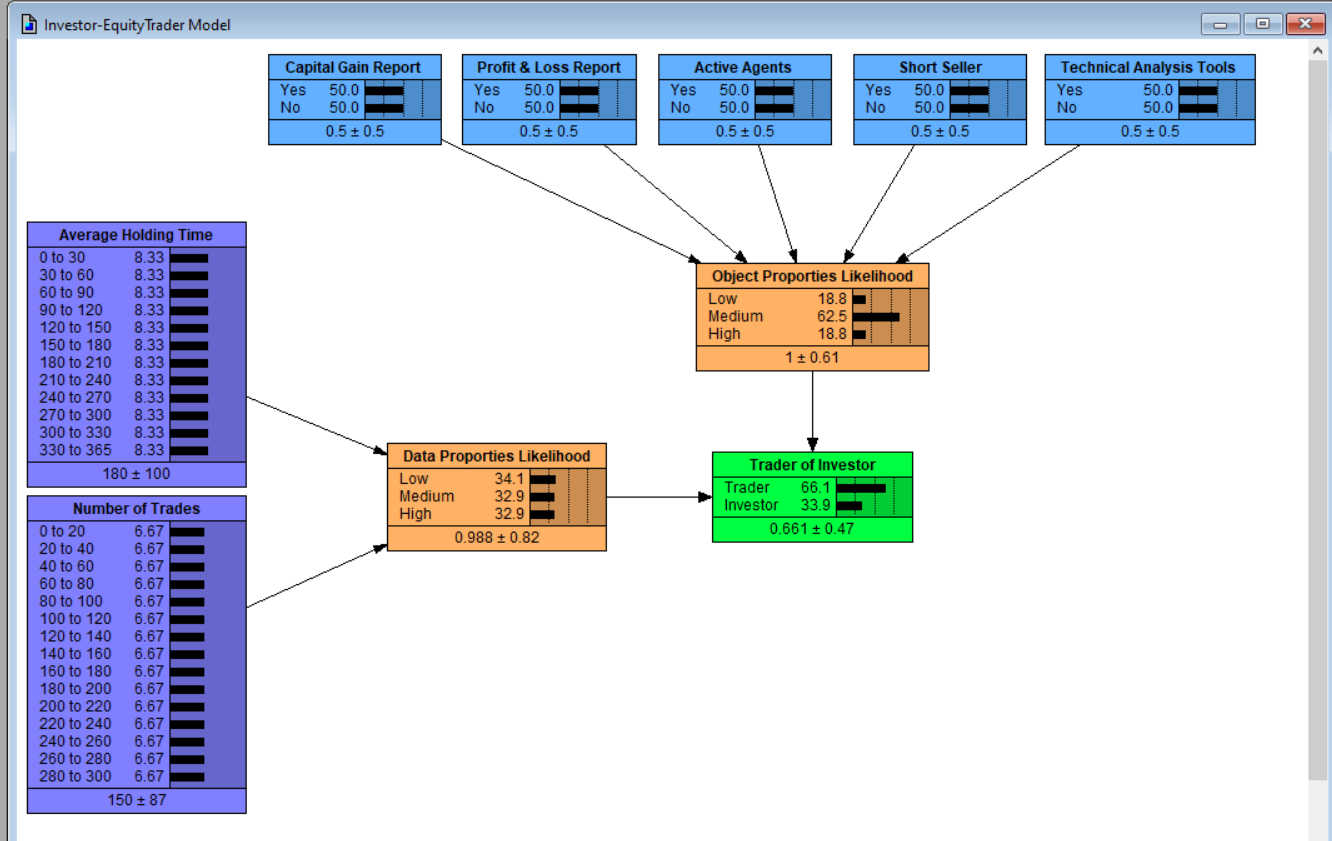

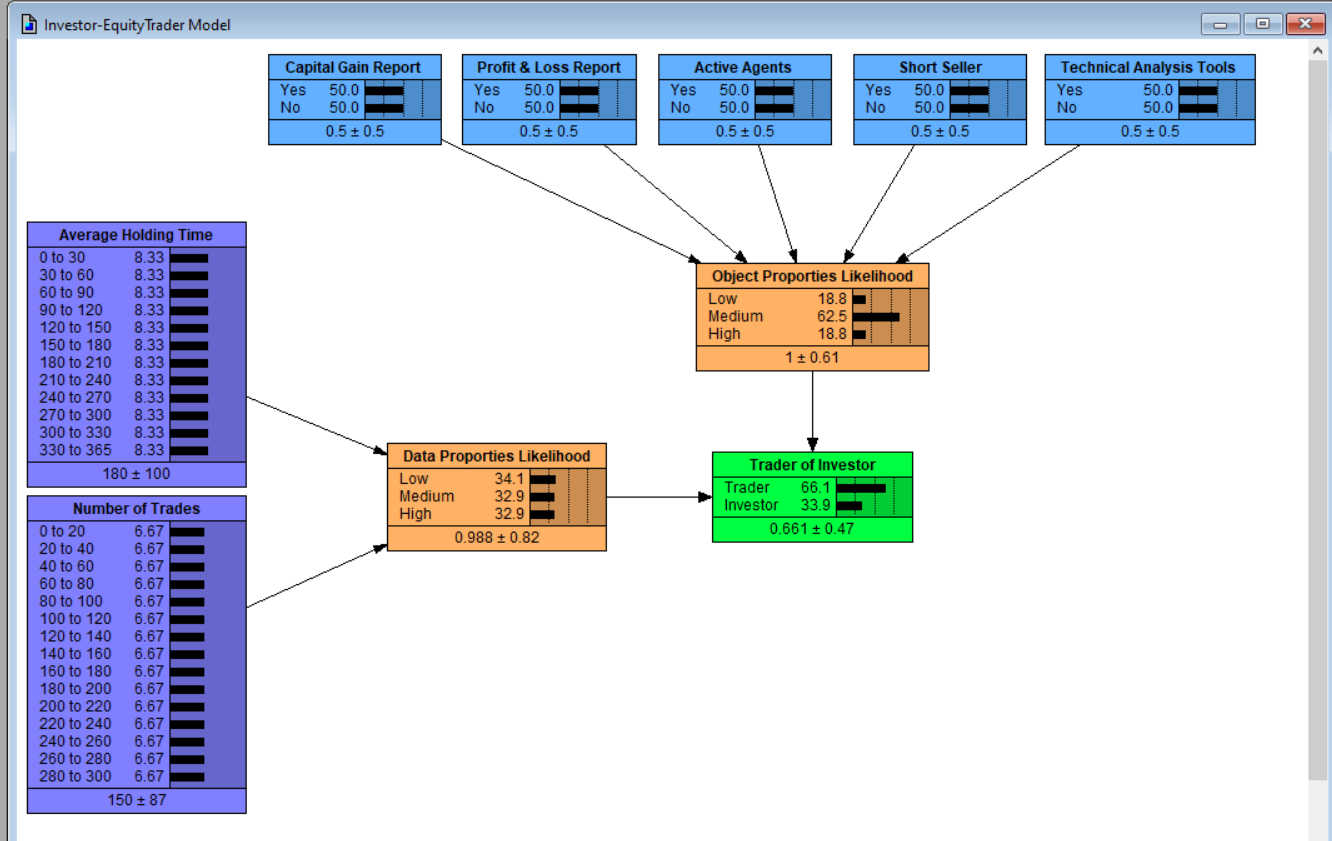

It’s possible to construct a model of the decision-making process a judge may apply given the case law available. Did the person maintain profit & loss or capital gains reports? Did the person use exotic trading techniques like short selling? Did the person use technical analysis tools? Did the person hold the equities or crypto for long periods of time or come in and out trades frequently? Did the person rely on active agents like brokers or carry out the trades themself? What was the person’s quantum of activity by buying and selling over a given time period?

Only by weighing all these variables can a determination be made. Weights can be applied to each variable based on impact on the overall decision – trader or investor.

Get Netica Software here.

Learn more about belief and decision networks here.

Download the share trader versus investor example file for Netica here.

I helped Mr Wong prove to the ATO that he was trading on his wife’s behalf rather than merely investing. A single stock with a catastrophic loss of 100% of the cost base. Some significant proportion of the portfolio. Casino Royale style. Trading losses are much more valuable than capital losses. Especially when you can offset those losses against your wife’s doctor salary across three financial years. Explore the case law here.

Case law carries precedence of how judges have interpreted and applied the law before. By reading case law together with the legislation, a probability distribution can be estimated i.e. share traders typically hold positions for shorter timeframes than investors. Share traders are also more likely to use technical analysis. Plus, there are other considerations. It’s not a simple binary and/or or yes/no.

It’s possible to construct a model of the decision-making process a judge may apply given the case law available. Did the person maintain profit & loss or capital gains reports? Did the person use exotic trading techniques like short selling? Did the person use technical analysis tools? Did the person hold the equities or crypto for long periods of time or come in and out trades frequently? Did the person rely on active agents like brokers or carry out the trades themself? What was the person’s quantum of activity by buying and selling over a given time period?

Only by weighing all these variables can a determination be made. Weights can be applied to each variable based on impact on the overall decision – trader or investor.

Get Netica Software here.

Learn more about belief and decision networks here.

Download the share trader versus investor example file for Netica here.

Accountant, Technologist & Futurist