Easy tax lodgement

Are you looking to reduce accounting fees?

Do you want to control your lodgements directly?

Suitable for Do It Yourself - requires MyGov and ABN.

Works for Company, Trust, Partnership and Self Managed Super Fund.

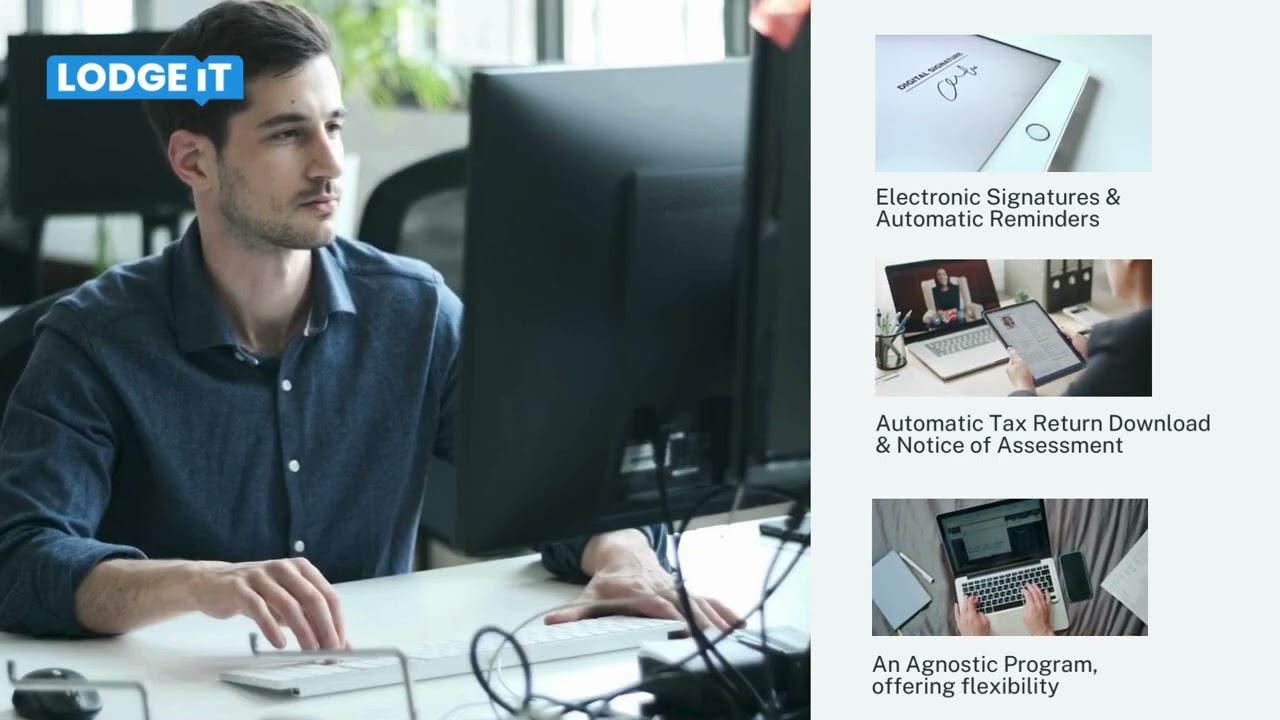

LodgeiT Benefits

Saving you time

LodgeiT automates the tax lodgement process, making it faster and more efficient.

Tax lodgement in 5 minutes for new users or instantly for users who have already set up their account and integrations.

Reduced expenditure

Lodge your tax return for $120 annually or $60 for Subsequent lodgements purchased in a bundle.

Also, free year-round for easy online BAS lodgement.

Instant data integration

LodgeiT pulls information directly from your current account software, including but not limited to MYOB, XERO, QBO, EXCEL.

One-stop shop for all business entities

Use Lodgeit for your

Company tax return lodgement,

Partnership tax return lodgement,

Self managed superannuation fund tax return lodgement

or

Trust tax return lodgement (ATO).

FREE to use & access anywhere

The LodgeiT cloud-based tax lodgement software is free to use, only pay when you submit your tax return (no hidden fees).

The benefit of LodgeiT being online means anyone in the team can access it anywhere, any time.

Complimentary reporting forms

- Consolidated groups notification of formation and member entrance/exit;

- Family trust election, revocation, or variation;

- FBT Return;

- Interposed entity election or revocation;

- PAYG withholding payment summary;

- Tax file number declaration;

- Taxable payments annual report.

Customer service support

You will always speak to a trained software assistant for any support requests.

These same industry agents have also written company tax return instructions, help guides and online video tutorials to help you set up LodgeiT easily and quickly.

Improve & streamline business processes

LodgeiT automates the tax lodgement process, making it faster and more efficient.

This reduces the time and effort required to prepare and submit tax returns, freeing up resources to focus on other business activities.

The highest accuracy and compliance

LodgeiT software ensures that tax returns are accurate and compliant with ATO requirements.

This reduces the risk of errors, penalties, and fines, which can be costly for businesses.

Customisable reporting

You will always speak to a trained software assistant for any support requests.

These same industry agents have also written company tax return instructions, help guides and online video tutorials to help you set up LodgeiT easily and quickly.

Team collaboration

LodgeiT allows multiple users to access and work on tax returns simultaneously.

This promotes collaboration and enhances communication between team members, which can improve overall productivity and efficiency.

Complete data security

LodgeiT provides a secure platform for storing and managing sensitive financial information.

This helps businesses to comply with data privacy regulations and ensures that their data is protected from cyber threats.

What our clients have to say

Pricing & Packages

First Lodgement

$120

Subsequent lodgements

$60 each

The subsequent lodgement price is ONLY applicable when forms are purchased in a bundle

LodgeiT makes lodging your company tax return simple with just 7 steps to get started:

STEP 03

Register for an MyGovId if you don’t have one

STEP 06

Lodge your company tax return!

STEP 04

Connect LodgeiT to the Australian Tax Office